The Rise of Fintech: Changing the Financial Game

Transformative Impact on Traditional Banking

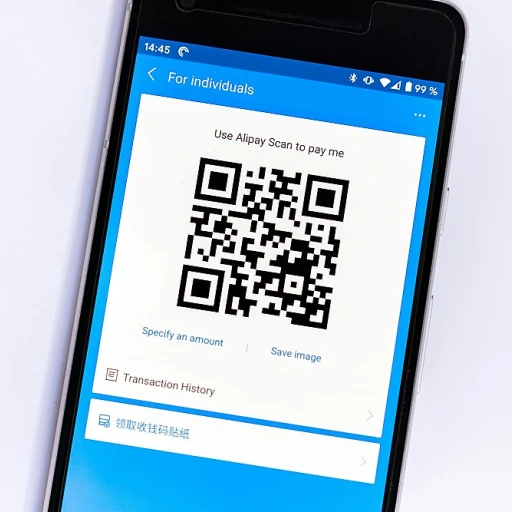

In recent times, financial technology, or fintech, has taken the banking industry by storm, fundamentally reshaping how people engage with their finances. The advent of fintech has revolutionized traditional banking systems by bringing in swifter, more efficient solutions that meet the demands of tech-savvy consumers and businesses alike. From mobile banking apps to digital wallets, fintech has changed the rules of the game. Traditional banks, known for their conservative approaches, are now finding themselves in a race against time to innovate or risk getting left behind. Fintech companies, armed with advanced technologies, have introduced seamless transactions and user-friendly interfaces that attract those who value convenience and speed.Unprecedented User Adoption

The widespread user adoption of fintech services has been astonishing, and not just limited to younger generations. Thanks to technology penetration and internet accessibility, people of all ages have embraced digital banking solutions. By offering real-time access, transparent services, and cutting-edge technology, fintech companies have gained a significant edge in winning over customers. As consumers grow more comfortable with digital platforms, their expectations for immediate financial services continue to rise. The rise of on-demand services in other sectors, like streaming entertainment and ride-sharing, has created a model of immediacy and convenience that the financial industry needed to follow. Fintech companies have been at the forefront of understanding these consumer needs, leveraging innovations like AI and blockchain to address pain points in financial services delivery. Companies and consumers alike are actively shifting towards fintech solutions, paving the way for a new financial frontier. For a deeper understanding of how this transformation is impacting the financial landscape, you can find more insights in this analysis of fintech zoom's growth.Fintechzoom: Real-Time Insights and Tools

Revolutionizing Financial Insights

As the financial world undergoes a seismic shift, real-time insights and tools have become the backbone of modern investing, thanks to platforms like Fintechzoom. Investors are no longer passive recipients of data; they actively engage with a deluge of information, allowing them to make informed decisions at breakneck speed. With the advent of Fintech technologies, traditional bank transactions have evolved, offering more transparency, efficiency, and precision. This change does not merely tweak the systems we were used to; it recalibrates them, arming investors with robust analytics and financial dashboards at their fingertips. Additionally, the integration of machine learning and artificial intelligence has brought about a new era where predicting stock trends and market behaviors becomes more science than chance. These innovations are helping investors to leverage data like never before. The significance of these platforms is further underscored by their ability to tap into cutting-edge tech investments. Fintechzoom and its contemporaries are paving the way forward by delving into what could be the next big disruptive technologies in finance. This evolution aligns with the broader trend of emerging technologies shaping venture capital, particularly in the fintech sector. As these platforms continue to develop, they demonstrate a commitment to the pioneering spirit of the digital economy, an aspect keenly discussed in forging ahead amid the ever-quickening pace of technological advancement.Blockchain and Crypto: The New Financial Frontier

Embracing Digital Currencies: The Impact of Blockchain and Crypto

The ascent of fintech has indelibly altered the financial landscape, as discussed in earlier sections. One of the most transformative elements within this shift is the advent of blockchain technology and cryptocurrencies. These digital innovations are redefining traditional banking paradigms, introducing new methods for transaction processing, and creating opportunities for investment previously unimaginable. Blockchain technology, the underlying framework for cryptocurrencies, offers a decentralized and transparent ledger system that is revolutionizing the way transactions are conducted and recorded. This system not only promises heightened security and efficiency but also ensures transparency that traditional banks often struggle to match. As a result, we are witnessing a growing acceptance and adoption of blockchain solutions across various financial services. Cryptocurrencies, with Bitcoin and Ethereum leading the pack, have become increasingly popular investment assets. They offer investors diversification options beyond traditional stocks and bonds, tapping into an entirely new financial frontier. While the volatile nature of these digital assets poses certain risks, their potential for high returns continues to attract venture capitalists and individual investors alike. Furthermore, initial coin offerings (ICOs) and decentralized finance (DeFi) have emerged as vital elements in this new financial ecosystem, providing innovative ways for companies to raise funds and for individuals to gain financial services without intermediaries. To truly grasp the overall impact of these technologies and how they intertwine with fintech's growth, it is crucial to stay informed on real-time developments. Platforms like Fintechzoom offer invaluable real-time insights and tools necessary for investors aiming to navigate this rapidly evolving financial landscape wisely. As we continue to explore the fintech boom, rest assured that blockchain and cryptocurrency are paving the way for a more innovative and accessible future in finance.Stock Market Trends: Keeping Up with Nasdaq and Dow Jones

Understanding Stock Market Dynamics in the Fintech Era

The stock market has long been a cornerstone of financial investment, but the advent of fintech has introduced a new layer of complexity and opportunity. As discussed in earlier sections, the rise of fintech is reshaping how we interact with financial services, and this transformation extends to how investors approach the stock market.

Platforms like Nasdaq and Dow Jones are no strangers to volatility, but fintech innovations are providing investors with real-time data and insights that were previously unimaginable. These tools enable investors to make more informed decisions, reacting swiftly to market changes. The integration of artificial intelligence and machine learning, as explored in another part of this article, further enhances predictive analytics, allowing for more strategic investment approaches.

Moreover, the intersection of blockchain and cryptocurrency, covered in a previous section, is beginning to influence traditional stock markets. As digital currencies gain traction, they present both challenges and opportunities for investors looking to diversify their portfolios.

In this rapidly evolving landscape, staying informed and adaptable is key. Whether you're a seasoned investor or new to the game, understanding the interplay between fintech advancements and stock market trends is crucial for navigating the future of finance.

Artificial Intelligence and Machine Learning in Finance

Artificial Intelligence's Transformative Influence in Financial Services

Artificial Intelligence (AI) and Machine Learning (ML) have become powerful catalysts driving the wave of innovation currently sweeping through the financial industry. Their integration into the financial world represents a paradigm shift, offering sophisticated tools and processes that optimize speed, efficiency, and accuracy in financial transactions and analyses. Banks and financial institutions are increasingly leveraging AI to enhance customer service through chatbots and automated customer support services. This not only reduces operational costs but also provides customers with faster and more reliable solutions to their queries. Moreover, AI's capability in handling large datasets facilitates personalized financial advice, creating a more tailored experience for clients. In addition to customer service, the role of AI extends to fraud detection and risk management. By analyzing patterns and anomalies in transactions, AI systems can identify potential fraud in real-time, ensuring greater security in financial operations. This proactive approach helps institutions safeguard against financial crimes, protecting both the business and its clients. Machine Learning, in particular, plays a significant role in algorithmic trading and robo-advisors. By processing vast amounts of historical and real-time data, ML models predict stock price movements, enabling more informed decision-making in stock market investments. This technology is not only enhancing the capabilities of human traders but also revolutionizing the way investments are managed either within or independently of human input. As seen with the other rapidly evolving elements like blockchain and crypto, as well as stock market trends highlighted earlier in our exploration of the fintech boom, AI and ML are central to the financial industry's ongoing evolution. These technologies are not merely complementary but foundational, setting the stage for a more dynamic, secure, and customer-centric financial ecosystem.Real Estate and Digital Assets: A New Era of Investment

An Unprecedented Era of Real Estate Investment

The realm of real estate is experiencing a transformative phase, much like the evolution seen with the rise of fintech. Real estate investments are no longer confined to physical properties alone. The digital age has ushered in an era where digital assets, such as virtual real estate in the metaverse, have become increasingly alluring to investors.

These digital assets are revolutionizing the way investors perceive property ownership and investment returns. Market platforms are emerging, providing opportunities to engage with these new asset classes just as companies within the fintech industry continue to introduce real-time insights, like those offered by Fintechzoom, to keep investors informed.

Tokenization: The Future of Real Estate Transactions

Tokenization is another technological advancement transforming real estate. It allows properties to be divided into smaller portions, enabling fractional ownership. This shift democratizes real estate investment, breaking down barriers for smaller investors to partake in larger deals. By leveraging insights from AI and machine learning, as explored in previous discussions, investors can make informed decisions about their participation in these tokenized projects.

Blockchain technology further enhances this process by ensuring secure and transparent transactions. As mentioned in previous discussions, the blockchain, along with the rise of cryptocurrency, continues to carve out a new frontier in finance, and it's also making waves in real estate by bringing integrity and efficiency to the table.

Hybrid Approaches: Merging Physical and Virtual Realities

The landscape of real estate is evolving towards a hybrid model where physical properties and digital assets coexist. This amalgamation represents an essential new phase for investors looking to diversify their portfolios. The integration of virtual properties with traditional real estate assets provides a robust framework for a more diversified risk management strategy.

In conclusion, the shift towards digital assets in the real estate market reflects a broader trend seen across finance and investment sectors. As this transition unfolds, investors positioned to leverage these changes stand to benefit immensely from the ongoing innovations that are shaping the future of investment dynamics.